JobKeeper 2.0 - Breaking Down How the Changes Will Affect Your Business

As we move closer to the shakeup of the JobKeeper payments, our team have put together a concise summary of the many parts that business and clients need to consider. Key dates, assessment of eligibility and how your employees will be paid are all considered in the below article.

As the financial fallout from the Covid-19 Pandemic continues for many businesses, significant changes are on their way for those Employers and small business currently being supported by the JobKeeper payments. Not only is it imperative for eligibility for the payment to be reassessed, the rates of payment and Eligible employees will be affected as well.

We have provided below a summary of the key areas to consider in the immediate future to ensure you maximise the support your business can receive.

SUMMARY OF KEY POINTS

The JobKeeper Payment, which was originally due to run until 27 September 2020, will now continue to be available to eligible businesses until 28 March 2021 if the relevant eligibility conditions have been met.

Payment rates are now divided into two tiers, for employees working greater and less than 20 hours per work

The payment rate of $1,500 per fortnight for eligible employees and business participants will be reduced to $1,200 per fortnight from 28 September 2020 and reduced again to $1,000 per fortnight from 4 January 2021.

From 28 September 2020, businesses seeking to claim the JobKeeper Payment will only be eligible if they meet the relevant turnover test in the September quarter. Businesses must use actual GST turnover test (rather than projected GST turnover) and compare their change in turnover from the September 2019 QUARTER compared to their September 2020 QUARTER

From January 4, businesses will only be eligible if they meet the relevant turnover test in the December quarter based on the same comparison of quarters for 2019 to 2020

The relevant date of employment will move from 1 March to 1 July 2020 for eligible employees

QUALIFYING FOR THE FIRST TIME UNDER JOBKEEPER 2.0

A business may not have participated in the original Jobkeeper scheme (i.e., between 30 March 2020 and 27 September 2020). However, if the business experiences the requisite decline in actual GST turnover for the September 2020 quarter, it may qualify from 28 September 2020 to 3 January 2021. To consider a new enrolment a business would also need to show that their projected Turnover for the June 2020 period was also below the relevant decline %.

REQUALIFYING UNDER JOBKEEPER 2.0 IF YOU MISS OUT IN THE SEPTEMBER ASSESSMENT

A business that originally qualified for Jobkeeper prior to 28 September 2020 may not qualify for the first Extension Period being the September 2020 quarter. HOWEVER if they have the requisite decline in actual GST turnover for the December 2020 quarter (i.e., when compared to the corresponding quarter in 2019) the business may re-qualify for payments under the second extension period to 28 March 2021

KEY NOTES FOR ASSESSING YOUR REDUCTION IN TURNOVER

When applying the new turnover reduction tests for the September 2020 quarter and December 2020 quarter, entities that are registered for GST must use the same method that is used for GST reporting purposes. Entities that are not registered for GST can choose whether to calculate GST turnover using a cash or accruals basis, but must use a consistent method.

Current GST turnover is based on actual sales that have been made. Current GST turnover also includes proceeds from the sale of capital assets, unless the sale is input taxed. Current GST turnover includes taxable and GST-free supplies, but should exclude input taxed supplies such as residential rental income and financial supplies like dividends, interest etc.

JobKeeper and ATO cash flow boost payments should be excluded from the calculation along with other payments that don’t represent consideration for a supply made by the entity.

JOBKEEPER PAYMENT RATE

Payment rates have been split into two tiers:

One rate for all eligible employees who, in the four weeks of pay periods before 1 March 2020, were working in the business for 20 hours or more a week on average, and for eligible business participants who were actively engaged in the business for 20 hours or more per week on average in the month of February 2020 (i.e. Full-time workers).

A lower rate for other eligible employees that worked fewer than 20 hours per week on average in the month of February 2020 (i.e. Part-time workers)

The current fortnightly rate will stay $1500 until September 27.

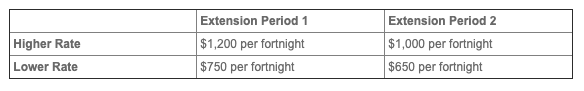

From 28 September 2020 to 3 January 2021, the JobKeeper Payment rates will be:

$1,200 per fortnight for > 20 hours per week

$750 per fortnight < 20 hours per week

From 4 January 2021 to 28 March 2021, the JobKeeper Payment rates will be:

$1,000 per fortnight

$650 per fortnight

*** Businesses and not-for-profits will be required to nominate which payment rate they are claiming for each of their eligible employees (or business participants).

*** For the JobKeeper fortnights starting 28 September 2020 and 12 October 2020 the ATO is allowing employers until 31 October 2020 to meet the wage condition for all employees included in the JobKeeper scheme.

ELIGIBLE EMPLOYEES

The eligibility rules for employees remains unchanged. This means employees are eligible if they:

are currently employed by the eligible employer (including those stood down or re-hired)

were employed by the employer at 1 July 2020

are full-time, part-time, or long-term casuals (a casual employed on a regular basis for longer than 12 months as at 1 July 2020)

were aged 18 years or older at 1 July 2020 (if they were 16 or 17 they can also qualify for fortnights before 11 May 2020, and continue to qualify after that if they are independent or not undertaking full time study)

are an Australian citizen, the holder of a permanent visa, a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder, and

are not in receipt of a JobKeeper Payment from another employer. If your employees receive the JobKeeper Payment, this may affect their eligibility for payments from Services Australia as they must report their JobKeeper Payment as income.

NOTIFICATION REQUIREMENTS

Employees:

From 28 September 2020, employers must provide details relating to eligible employees and also the applicable rate for which they are eligible in respect of their employees as part of the information that must be provided to the Commissioner.

There will be no requirement to notify the Commissioner a second time relating to Payments for the second extension period as no further testing of the hours of work is required to determine the rate of payment.

Where an employer fails to notify the Commissioner of the applicable payment rate in respect of an employee for JobKeeper fortnights commencing on or after 28 September 2020, the employer is not eligible for Jobkeeper UNTIL a valid notification is made. This applies regardless of whether the employer has been receiving jobkeeper in respect of the employee prior to 28 September 2020.

In addition, employers must also notify their employees in writing within seven days of advising the Commissioner of the payment rate applicable to the employee.

Eligible Business Participants

Entities must notify the Commissioner (in the approved form) about whether the higher or the lower rate applies to an eligible business participant for fortnights commencing on or after 28 September 2020.

With the exception of sole traders, entities must also notify the eligible business participant within seven days once such a notice is provided to the Commissioner.

JOBKEEPER FORTNIGHTS – INCLUDING EXTENSION PERIOD 1

SUMMARY CHECKLIST TO CONSIDER ELIGIBILITY

To assist in determining your business’s eligibility for the Extension Payment, we have provided below a basic checklist to consider. The following questions are intended to assess eligibility for the Extension to the JobKeeper Scheme.

If you have answered "yes" to ALL of the above you may qualify for the JobKeeper Payments from the ATO. If you have answered any question "No", you are unlikely to qualify for the JobKeeper Payment Scheme. We can assist you in confirming your eligibility and completing all necessary forms. Please contact us as a matter of urgency.

If you have answered "yes" to ALL of the above you may qualify for the JobKeeper Payments from the ATO. If you have answered any question "No", you are unlikely to qualify for the JobKeeper Payment Scheme.

Please contact our office if you would like to discuss how these changes will affect your business and if we can assist you in confirming your eligibility and completing all necessary forms. Our helpful accountants are waiting to assist.