Super Contribution Caps for 2021/22: What This Means for You

Over the last few weeks we’ve had confirmation of the changes to superannuation contribution caps. The release of the November 2020 Average Weekly Earnings data means we now know for sure that the concessional contributions cap will increase from $25,000 to $27,500 from 1 July 2021. This is a welcome change for many people, as the last time we saw concessional contribution caps above $25,000 was back in 2016/17.

So what does this mean for your planning?

For a start, indexation of the concessional contributions cap automatically flows through to an increased non-concessional cap. This means $100,000 will become $110,000 from 1 July 2021.

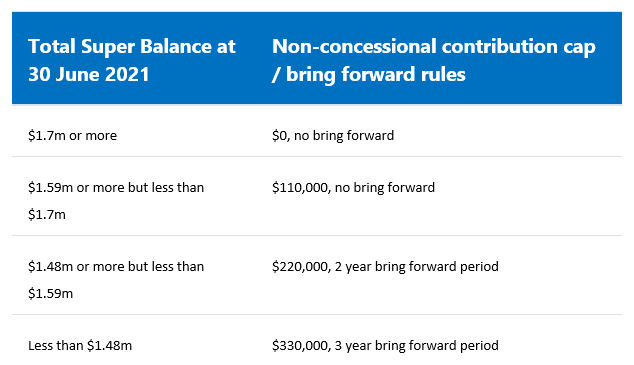

We can also now populate the (slightly complex) table of bring forward thresholds and amounts for 2021/22. It’s complex because it depends on both the general transfer balance cap (increasing to $1.7m from 1 July 2021) and the non-concessional contributions cap (as we now know, this is also increasing).

Importantly, the same table applies to everyone. While the personal transfer balance cap will be different for different individuals from 1 July 2021, this table of contribution thresholds depends on the general transfer balance cap ($1.7m) regardless of the individual’s personal cap.

There are a number of important flow on impacts for clients to consider.

Timing of large non-concessional contributions

Those considering large non-concessional contributions will need to think carefully about whether they do that in 2020/21 or 2021/22.

Consider a 60 year old client with a $1m total superannuation balance at 30 June 2020 who has not previously used the bring forward rules but is about to do so.

Contributing $300,000 now locks in the 2020/21 non-concessional cap of $100,000 for all three years (2020/21, 2021/22 and 2022/23) even though the cap will actually increase next year. All other things being equal, it may be preferable to contribute $100,000 now and $330,000 in July 2021.

What about those with slightly more super – say, hovering around the $1.4m mark? They have a delicate balance between:

Contributing the full $300,000 now while they are still below the key threshold for this year ($1.4m at 30 June 2020), vs

Contributing only $100,000 now, increasing the total superannuation balance and possibly impacting their ability to maximise their bring forward in 2021/22.

For example, if this client’s total super balance was instead $1.35m at 30 June 2020, a $300,000 contribution would clearly be possible in 2020/21.

Contributing $100,000 in 2020/21 instead, however, might mean their balance at 30 June 2021 scrapes over one of the new thresholds ($1.48m). Their non-concessional contributions would be limited to only $220,000 in 2021/22 (a bring forward period of two years rather than three).

All that said, even this outcome is not such a bad thing. While it might not be as much as they had hoped ($100,000 in 2020/21 and $330,000 in 2021/22), the total contributed for the three years up to 30 June 2023 would be $320,000 ($100,000 in 2020/21 plus $220,000 in 2021/22). That’s still better than putting the full $300,000 in now.

Watching unexpected impacts on the bring forward rules

We all like to think that bring forward periods are carefully considered and happen exactly when the client meant to use these rules to maximise their non-concessional contributions.

In fact, remember that they are triggered automatically whenever the annual non-concessional cap is exceeded. The contributor has no choice about the period of the bring forward. If someone with a total super balance of $1m at 30 June 2020 has even 1 cent more than $100,000 counted for their non-concessional contribution cap in 2020/21, they will automatically lock in a three year period up until 30 June 2023 and their non-concessional contributions over that time will be limited to $300,000.

Traps for the unwary are small contribution amounts that have been forgotten about which cause the person to exceed the cap even though they thought they had only contributed $100,000. For example:

personal contributions to an industry fund to maintain insurance cover

personal contributions for which a tax deduction has been denied

spouse contributions

SMSF expenses paid personally that weren’t reimbursed, and

excess concessional contributions where no action was taken on the excess notice and so the contributions remained in the fund (remember these only count towards the non-concessional contributions cap if they are not refunded)

An increase in the superannuation contribution caps can only be a good thing for those people wanting to build their investment base inside super. If you’d like to see how any of these new rules may apply to you, please don’t hesitate to contact us.