Accounting

The accounting team at Schuh Group are very well equipped to assist you with all of your accounting needs. Our extensive experience, combined with a full suite of services, means that we can offer our clients a complete financial service under the one roof.

Schuh Group has been helping individuals and businesses with their accounting needs for over 35 years. As accounting specialists, we believe that taxation is an excellent opportunity to sit down and review your business performance. Our accountants can help you to use these figures to optimise your wealth creation.

We are particularly attuned to the needs of small and medium businesses and entrepreneurs. We can offer strategic advice, business information processing and management, all the way through to succession planning.

We strive to provide the highest level of service to ensure every effort is made to provide client service excellence. Our team takes the time to listen and deliver practical, useful business recommendations to help our business clients prosper.

Gympie CPA Services

Our extensive suite of services covers everything from basic book keeping through to the most complex accounting needs, including:

Benchmarking

Book keeping

Budgeting

Cash flow forecasting

Auditing

GST

Taxation

Business Activity Statements

Our entire team firmly believe that our business is the result of your business success. Our mission is to deliver value and results for our clients, regardless of their goals or stage in business. Creating wealth for our clients is our focus.

We welcome you to contact us today and find out how a Gympie CPA may be able to assist with your business accounting requirements.

Client Portal

Link to Client Portal

Resources

Useful Links

Trying to find a high-quality and useful site on the web can often be a time consuming experience. To save you the trouble we have compiled a list of websites that we have found to be valuable sources of information. Clicking on the link will open a new window for you. Note: The links provided are for general interest only. We do not endorse any products and services offered by the websites listed on this page.

Business Planning

Business.gov.au

Business Software

Xero

Saasu

Microsoft

Acclipse

BankLink

MYOB

Reckon

Sage Australia

Funding

Government

AVCAL

Financial Institutions

ANZ

Commonwealth Bank

National Australia Bank

Westpac

Bank of Queensland

Bendigo Bank

Macquarie Bank

St George Bank

Australian Tax Office

ATO Website

Business.gov.au

ABN Registration

TFN Registration

GST Registration

Fringe Benefits Tax Registration (FBT)

Payroll Tax Registration

Pay As You Go (PAYG)

Human Resources

Australian Human Rights Commission

Health & Safety

Leave & Public Holidays

Resolving Industrial Relations Disputes

Terminating Employment

Exiting A Business: Succession

Succession Planning

Transferring Ownership

Insolvency

Insolvency & Trustee Service

Selling Your Business

Selling Your Business

Finance

Australian Stock Exchange

New Zealand Stock Exchange

The NASDAQ Stock Market

US Stock Exchange

London Stock Exchange

Foreign Exchange Rates

Key Dates - 2020

14th June 2020 – Lodgement date for monthly reporting requirements for the JobKeeper payment. Lodgement of May Actual GST Turnover and projection of June GST Turnover.

21st June 2020 – Lodge and pay May 2020 monthly Business Activity Statement.

22nd June 2020 – This would be a good date to have all additional superannuation contributions lodged for the 2020 financial year to ensure time for processing prior to the 30th June 2020 cut off.

25th June 2020 – Lodgement of the 2020 Fringe Benefits Tax Annual Return for tax agents if lodging electronically. Payment is due by 28th May 2020.

30th June 2020 – Last day for business to enrol in the JobKeeper program if they have meet the downturn requirements for the month of June. Any claims wanting to be made for the June period MUST have an enrolment and identify employees/business participant by this date.

30th June 2020 – Superannuation contributions for the June 2020 quarter must be paid by this date to qualify for a tax deduction in the 2019-2020 financial year

30th June 2020 – Farm Management Deposits must be deposited and confirmed by this date to qualify for deduction in the 2019-2020 financial year.

30th June 2020 – All trustees who make beneficiaries entitled to trust income by way of a resolution must do so by the end of an income year (30 June). This resolution will determine who is to be assessed on the trust's taxable income

14th July 2020 - Due date for payers to issue the following types of PAYG withholding payment summaries to payees (includes employees and recipients of certain other payments)

PAYG payment summary - individual non-business for employees, company directors and office holders who received salary, wages, pension payments, compensation, allowances or reportable fringe benefits.

PAYG payment summary - foreign employment for employees, company directors and office holders who received income from foreign employment, or for work in the Joint Petroleum Development Area.

PAYG payment summary - business and personal services income for non-employees who have made a voluntary agreement to withhold tax, or were employed under a labour hire arrangement, or received certain specified payments, or earned personal services income through a separate entity.

PAYG payment summary - superannuation income stream for payees who received an income stream benefit (a pension or annuity) from a superannuation fund, approved deposit fund or life insurance company.

Payment summaries for various other types of payments subject to PAYG withholding must be issued within a short period after the payment is made. Employers utilising Single Touch Payroll (STP) are not required to issue payment summaries for amounts covered by STP.

14th July 2020 - Lodgement date for monthly reporting requirements for the JobKeeper payment. Lodgement of June Actual GST Turnover and projection of July GST Turnover.

21st July 2020 - Lodge and Pay June 2020 Monthly Business Activity Statement

31st July 2020 – For the final quarter of 2020 (April to June) you will need to report and finalise your STP data.

21st July 2020 – The QLD Payroll Tax Annual Return is due for lodgement.

28th July 2020 – Due date to lodge and pay quarterly activity statement for the June 2020 quarter if lodged by paper.

28th July 2020 – Due date for employers to pay superannuation guarantee contributions for the June 2020 quarter.

31st July 2020 - Last day for business to enrol in the JobKeeper program if they have meet the downturn requirements for the month of July. Any claims wanting to be made for the July period MUST have an enrolment and identify employees/business participant by this date.

7th August 2020 – Lodgement of the July 2020 Monthly QLD Payroll Tax obligation.

14th August 2020 - Lodgement date for monthly reporting requirements for the JobKeeper payment. Lodgement of July Actual GST Turnover and projection of August GST Turnover.

14th August 2020 – Due date for the following entities to lodge the PAYG payment summary statement for the year to 30 June 2020:

large withholders (total annual PAYG withholding more than $1m).

small and medium withholders who don't have a tax agent or BAS agent involved in preparing the report.

Types of payment summaries that may need to be reported include:

PAYG payment summary - individual non-business.

PAYG payment summary - foreign employment.

PAYG payment summary - business and personal services income.

PAYG payment summary - superannuation income stream.

PAYG payment summary - superannuation lump sum.

PAYG payment summary - employment termination payment.

Small and medium withholders who use a tax agent or BAS agent to prepare this report can lodge by 30 Sep 2020 (if payees include unrelated persons) or the due date of their tax return (if closely held payees only). Employers utilising Single Touch Payroll (STP) are not required to provide an annual report for amounts covered by STP.

21st August 2020 - Final date for eligible monthly GST payers to elect to report GST annually for 2020/21

21st August 2020 - Due date to lodge and pay monthly activity statements for July 2020.

25th August 2020 – Lodgement of the June 2020 Business Activity Statement if lodging electronically through a BAS or Tax Agent.

28th August 2020 – Due date for taxpayers in the following industries to lodge the taxable payments annual report in respect of payments made to contractors providing services to the taxpayer during the year to 30 June 2020:

Building and constructions services

Cleaning services

Courier services

Road freight transport services

Information technology, computer system design and related services

Security and surveillance providers and investigation services

28th August 2020 - Employers who fail to pay the minimum superannuation guarantee contributions by this date must pay the superannuation guarantee charge (SGC) and lodge a Superannuation guarantee charge statement - quarterly by 28 Aug 2020. The SGC is not tax deductible.

31st August 2020 - Last day for business to enrol in the JobKeeper program if they have meet the downturn requirements for the month of August. Any claims wanting to be made for the August period MUST have an enrolment and identify employees/business participant by this date.

7th September 2020 – Lodgement of the July 2020 Monthly QLD Payroll Tax obligation.

14th September 2020 - Lodgement date for monthly reporting requirements for the JobKeeper payment. Lodgement of August Actual GST Turnover and projection of September GST Turnover.

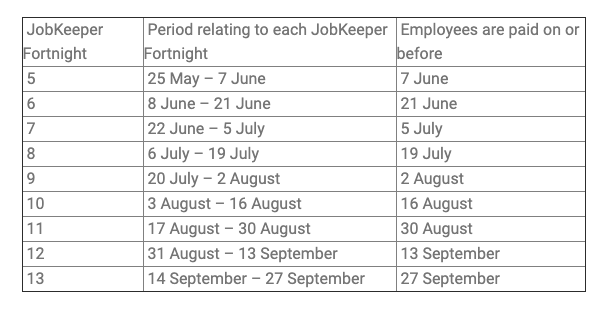

JOBKEEPER

When considering the important dates over the next few months, it is also important as our businesses regroup after the peak of the COVID pandemic, to remember to pay their employees who are on the JobKeeper program the gross amount of $1,500 per fortnight by the relevant fortnight date. We have provided below a summary of the remaining fortnights under the JobKeeper program.

Tax Facts

You may find the following information on various tax issues useful. Personal circumstances always vary, so please ensure you contact us for specific advice.